Unlock your Health Savings Accounts (HSAs) Full Tax Savings and Investment Potential

As open enrollment season for healthcare plans approaches, combined with the reality that retirement healthcare expenses often exceed a staggering $300,000 for couples, there’s no better time to explore Health Savings Accounts (HSAs). These accounts are designed to help individuals and families prepare for future medical costs but can also serve as a powerful triple tax-advantaged investment vehicle. Surprisingly, many new clients haven’t been fully harnessing HSA’s entire tax and investment benefits.

If you're healthy and don’t anticipate significant medical expenses next year, now is the time to consider maximizing your HSA contributions. In this blog post, we'll explore why HSAs should be considered as part of your financial plan and how they have the potential to save you thousands of dollars in taxes.

Why Consider an HSA?

Immediate Tax Deduction: HSA contributions are tax-deductible in the year you make the contribution. For example, if you’re in the 24% federal tax bracket and have a family HSA, you can save $1,992 on your 2024 federal tax return ($8,300 x 24%). Many states also provide an additional state tax deduction, and contributing with pre-tax dollars allows you to avoid the 7.65% FICA payroll tax (e.g., Social Security and Medicare).

Tax-Free Investment Growth: Consider investing your HSA funds to benefit from tax-free dividends, capital gains, and interest. For instance, if you’re in the 24% federal tax bracket, dividends and capital gains will typically be taxed federally at 15% or 18.8%, whereas interest would be taxed at your federal ordinary income tax rate of 24%.

Tax-Free Withdrawals: When HSA funds are used for qualified medical expenses, withdrawals are tax-free. For example, if you’re in the 24% federal tax bracket, it’s important to note that long-term capital gains on sales would typically be taxed federally at 15% or 18.8%.

Flexibility: HSAs can be rolled over after you switch jobs and retained during retirement.

Strategic Use of Funds:

Maximize Investment Growth:

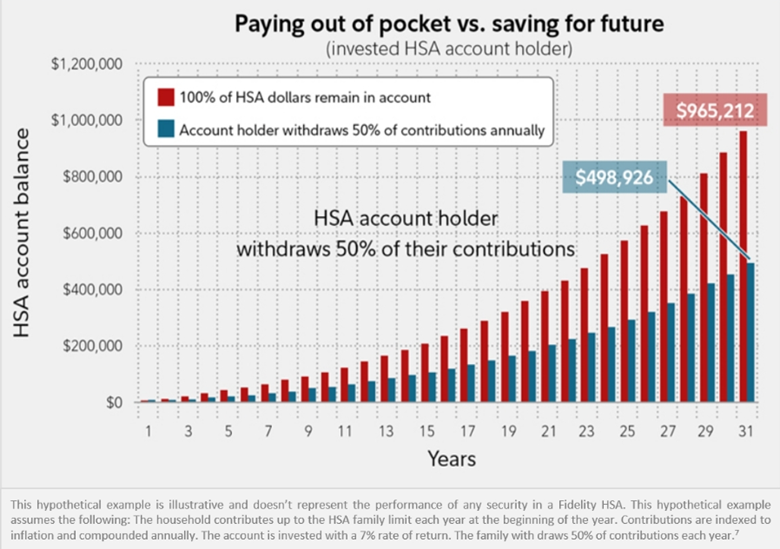

After funding your HSA, consider using non-HSA funds for immediate medical expenses. This strategy allows your HSA balance to remain invested for potential growth. To illustrate, let’s use an example: Assuming a 7% investment return, if you keep your HSA invested for 30+ years, you could potentially have approximately $450,000 more than someone who withdraws 50% of their HSA balance annually for current medical expenses.

We generally recommend a more aggressive investment approach for HSAs in your portfolio (e.g., more stocks), as these are tax-free assets. However, the suitability of this approach depends on factors like your time horizon, risk tolerance, and capacity for risk.

Source: Fidelity.com

Record-Keeping Importance: When using non-HSA funds for current medical expenses, keep detailed records since you can take tax-free HSA distributions at any time for prior qualified medical expenses incurred after establishing the HSA. This approach is particularly advantageous during retirement, and we often recommend distributing funds for prior medical expenses around the ages of 70 to 80, allowing for many years of tax-free investment growth.

Future Health Care Costs

For reference, a 65-year-old couple retiring this year can expect to spend an average of $315,000 in health care and medical expenses during their retirement, according to an estimate by Fidelity Investments, so HSAs assist with future medical expenses.

Contribution limits:

2023: individual $3,850; family $7,750 (age 55 and older have additional catch-up contribution of $1,000)

2024: individual $4,150; family $8,300 (age 55 and older have additional catch-up contribution of $1,000)

Reminders: To contribute to an HSA, you need to be enrolled in an HSA-eligible health plan and can’t be enrolled in Medicare. This means:

Minimum Deductible Amount for 2023: Single $1,500; Family $3,000

Maximum Out-of-Pocket Amount for 2023: Single $7,500; Family $15,000

Other Considerations:

Be aware that there is a penalty for withdrawing funds for non-qualified medical expenses before age 65, which is generally 20%. You would also be subject to income taxes on the non-qualified withdrawal.

Be mindful that if the beneficiary is not a spouse, the HSA will no longer be treated as a tax-free HSA upon inheritance, and the fair market value of the HSA becomes taxable income to the beneficiary.

Conclusion:

Health Savings Accounts (HSAs) represent a powerful investment vehicle with triple tax advantages that can significantly improve your goal of reaching financial independence. With estimated healthcare costs in retirement often surpassing $300,000, contributing to an HSA is often a prudent financial decision.

For personalized guidance on HSAs or to ensure you are taking advantage of other tax strategies, reach out to Prepared Financial Planning LLC for a free assessment: https://www.preparedfp.com/assessment or send us an email at andrew@preparedfp.com.

For disclosure information click here.