Four Tax Saving Strategies to Review Before Year-End

Based on Morningstar research, the average investor gives up 1 to 2 percentage points of their annual return to taxes. While 2% may seem insignificant, a 2% tax drag on a $500,000 portfolio over 10 years earning 7.5% – that's a loss exceeding $175,000! Therefore, as year-end approaches, it's the perfect time to ensure you minimize the taxes paid to Uncle Sam. This blog post will review some essential tax strategies worth considering.

If you have any tax questions, schedule a free assessment here or send us an email: andrew@preparedfp.com.

Source: https://www.washingtonpost.com/brand-studio/wp/2022/01/03/are-taxes-dragging-you-down/

1) Maximize Retirement Savings: If you have the financial resources, consider maximizing your tax-deferred and tax-free retirement savings:

2023 Contribution Limits:

Health Savings Account (HSA):

Individual $3,850

Family $7,750

Catch-up Contribution (Age 55 and older): Additional $1,000

Reminders:

To contribute to an HSA, you need to be enrolled in an HSA-eligible high deductible health plan and can’t be enrolled in Medicare.

You generally have until the tax filing deadline to contribute to an HSA.

Note: I recently wrote a blog post on investing HSAs. Click here to read.

401(k) / 403(b):

Standard Contribution: $22,500

Catch-up Contribution (age 50 and older): Additional $7,500

Other Considerations:

Ensure you're contributing at least up to your company's match – it's essentially free money!

Based on your current and anticipated future tax rates, review the pre-tax versus after-tax (e.g., Roth 401(k)) percentage of your contributions.

Consider setting your portfolio to automatically rebalance every quarter if the option is available.

Roth IRA / Backdoor Roth IRAs:

Standard Contribution: $6,500

Catch-up Contribution (age 50 and older): Additional $1,000

Important: Income limits apply for Roth IRA contributions, but not Backdoor Roth IRA Conversions.

Other Considerations:

Given the tax-free status of this account, consider investing in more growth-oriented assets depending on your risk tolerance, time horizon, and risk capacity.

You have until the tax filing deadline to contribute to a Roth IRA.

Consider funding your children’s tax-free Roth IRAs if they have enough eligible earned income.

Wisconsin 529 College Savings Plan:

$3,860 state tax deduction per beneficiary in Wisconsin for single filers or married filing jointly.

Reminder: Ensure you review the investment risk of your child's 529 plan, making certain it aligns with the anticipated timeline for funding their college education.

Flexible Spending Account (FSA): Since FSAs operate on a "Use it or lose it" basis, ensure you have a plan to spend the money in your account before the spending deadline.

Gift Tax Annual Limit: $17,000 each

Invest: Make sure all your retirement investment accounts are actively invested. Some clients assume their accounts invest automatically, but we’ve seen cases where retirement accounts have been sitting in cash, earning nothing for months and even years.

2) Reduced Income Year? Are you in a year(s) of reduced income, perhaps due to a recent retirement (before social security benefits or RMDs begin), job loss, new business venture, year-long sabbatical, or a lower annual bonus? If so, this could be the perfect time to review the following strategies that can save you taxes over your lifetime.

Source: https://arnoldmotewealthmanagement.com/roth-conversions-guide/

Roth IRA Conversions: This strategy involves converting a portion of your pre-tax retirement accounts, such as a Rollover IRA, Traditional IRA, or 401(k), into a tax-free Roth IRA. While you'll incur taxes during the conversion, the goal would be to pay taxes at lower rates now than in the future. Key considerations for Roth IRA Conversions:

Tax Rate Optimization: Strategically converting a portion of your pre-tax retirement savings to a Roth IRA during periods of lower income allows you to pay taxes at a more favorable rate. This not only reduces your overall lifetime tax burden but also maximizes wealth accumulation. Also, consider spreading conversions over multiple years to further mitigate the tax impact.

Future Tax Rate Uncertainty: As you review conversions, it's crucial to note that in 2026, tax brackets are slated to revert to higher pre-TCJA (Tax Cuts and Jobs Act) federal marginal tax rates. Furthermore, considering the U.S. National Debt is approaching $34 trillion, there's a probable expectation that future tax rates may increase to meet our government's debt obligations.

Tax Diversification: Having multiple tax buckets for future withdrawals (tax-free, tax-deferred, and taxable) assists with tax diversification, helping to maintain a more stable tax rate during retirement.

Tax-Free Growth: Following the conversion, a Roth IRA offers the unique advantage of tax-free investment growth. This feature not only provides potential long-term benefits for your own retirement but also creates a tax-efficient vehicle for your heirs. Therefore, a Roth IRA can serve as a valuable asset in passing on wealth while minimizing tax implications.

Tax Considerations:

IRMAA Impact: Keep in mind that Roth IRA conversions will increase your taxable income during the conversion year, potentially influencing the Income-Related Monthly Adjustment Amount (IRMAA). Therefore, this may affect the fees you pay on Medicare Part B and Part D premiums, as well as other taxes.

State Taxes: State tax rules can vary, so it’s essential to understand how the conversion might affect your state tax liability.

Tax Projection: If you're considering a Roth IRA Conversion and want a personalized assessment of its financial impact, reach out to Prepared Financial Planning LLC. We can run a tax projection to help you determine if a Roth IRA Conversion is a prudent strategy for you.

3) Tax-efficient Charitable Giving Techniques: If you are charitable-minded, then review these tax-efficient strategies to amplify your giving:

Donor Advised Funds (DAFs):

Why Utilize a DAF?

A Donor Advised Fund (DAF) can significantly increase your tax savings. This strategy involves donating appreciated securities or cash to a DAF with your preferred custodian, such as Schwab or Fidelity.

Serving as a giving fund, a DAF not only provides a tax benefit in the year of contribution but also empowers you, as the donor, to actively direct sustained support to your favorite charities over an extended period. You maintain control over these future donations, managing charitable distribution either through the online DAF portal at your preferred custodian or directly through your beneficiaries.

Tax Benefits of Front Loading: With recent decreases in federal itemized deductions available (Schedule A on your tax return), many individuals no longer receive yearly tax benefits for direct charitable donations. For instance, only about 13% of Americans itemize deductions, using the federal standard deduction instead. Therefore, to qualify for a charitable tax deduction, consider making multiple years of donations to a DAF in one year.

Example: Assume you're married, under the age of 65, and annually donate $8,000 to charities. Additional itemized deductions include $9,000 for mortgage interest and $10,000 for state taxes (maxing out federally at $10,000). In 2023, your total itemized deductions would be $27,000, falling just short of the standard deduction, which is currently $27,700. Therefore, you would receive no additional tax deduction for your $8,000 charitable donation.

Alternatively:

However, if you donated four years of charitable contributions to a DAF ($8,000 x 4 = $32,000), your itemized deduction would increase to $51,000, making you eligible to itemize on your tax return. In the 24% tax bracket, your additional federal tax savings would be $5,592, and in the 32% bracket, the tax savings would be $7,456.

With this technique you will still donate the same $8,000 per year to your chosen charities (through your online DAF portal), but since you've front-loaded your giving fund your tax savings will be substantial.

Other DAF Considerations:

Appreciated Securities:

DAFs can be funded with cash or long-term appreciated securities (e.g., stocks, mutual funds, ETFs). Opting for appreciated securities is more tax-efficient, providing a deduction for the securities' full market value while avoiding capital gains realization.

Low Basis Company Stock: If you're employed by a company whose stock has appreciated significantly, consider seizing the opportunity to transfer some of these early-acquired securities to your DAF.

Recordkeeping Simplified: Using a DAF reduces paperwork. For instance, contributing stock to the DAF allows you to make donations to your favorite charities directly through your custodian’s DAF website. This streamlined approach simplifies the process compared to donating appreciated stock to multiple charities and managing tax paperwork.

Timing of DAF Contribution: Consider front-loading DAF contributions during higher income years like before retirement, during the sale of a business, or when liquidating highly appreciated company stock. This can maximize your tax savings on future charitable donations.

Beneficiaries: You have the flexibility to designate DAF beneficiaries, choosing either charitable organizations or your heirs. Choosing your heirs as a beneficiary can empower them to support their preferred charitable causes after your passing, making your DAF a valuable estate planning tool.

Qualified Charitable Distribution (QCDs)

What is a QCD? After reaching age 70.5, you have the option to make Qualified Charitable Distributions (QCDs), which involves donating directly to charities from your pre-tax IRA. This strategic approach not only sidesteps income taxes on the distribution but also reduces your Required Minimum Distribution (RMD) amount.

Tax Benefits: The distribution from a QCD is not considered taxable income. For instance, if you donated $10,000 through a QCD and fall within the 24% or 32% federal income tax bracket, your federal tax savings would amount to $2,400 or $3,200, respectively.

Annual Limit: $100,000 (indexed starting in 2024). If you file taxes jointly, both you and your spouse can each make a QCD from your respective accounts within the same tax year, allowing for a combined total of up to $200,000.

Record keeping: It's crucial to keep track of QCDs (since QCDs lower your RMD amount), as investment custodians typically don't maintain records of these transactions. If you're an investment management client, we can assist with QCD distributions and provide your annual QCD amount to your CPA.

4) Is your portfolio tax-efficient? Asset location matters significantly, since different investments and investment accounts are subject to different tax rates, impacting your after-tax returns. Therefore, consider investing your most tax-inefficient assets in tax-deferred accounts and your highest-expected-return assets inside tax-free accounts.

Source: https://russellinvestments.com/-/media/images/us/blogs/images/gilbert_math1.png

Tax-inefficient Assets: Assets like REITs (real estate securities), taxable bonds, some actively managed stock funds, high-dividend-paying equities, liquid alternatives, and commodity funds tend to be less tax-efficient. Consider sheltering these assets in tax-deferred accounts.

Tax-efficient Assets: Assets, such as index funds and tax-exempt municipal bonds (federally tax-free), are more tax-efficient and are more suitable for your taxable account, depending on your tax bracket.

Review Your 2022 Tax Return:

Ordinary Dividends (Form 1040 Line 3b minus line 3a): Ordinary dividends are taxed at your higher ordinary income tax rate, unlike qualified dividends taxed at lower capital gain rates. You can lower ordinary dividends by relocating these assets taxed at higher income tax rates from your taxable brokerage account to tax-deferred or tax-free accounts, depending on tax consequences and after-tax return considerations.

Tax-Exempt Interest versus Taxable Interest (Form 1040 Line 2a vs. 2b):

Line 2a reflects tax-exempt interest (generally municipal bonds) which aren’t taxed federally, while line 2b shows taxable interest which is taxed at ordinary income tax rates. Ensure you are reviewing your marginal tax rate to maximize after-tax fixed income returns (taxable bonds versus municipal bonds) and cash holdings.

If line 2b is substantial, it suggests a significant amount of taxable bonds or cash equivalents which can be reviewed in Part I of Schedule B (Form 1040).

Fixed income:

Consider relocating some taxable fixed-income holdings to tax-deferred accounts (e.g., 401(k), 403(b), Rollover IRA) since these assets are taxed at ordinary income tax rates.

Selling fixed-income assets now could also provide tax-loss harvesting opportunities since most bond holdings have experienced substantial losses over the last couple of years.

Cash holdings: Make optimal long-term investment decisions for retirement savings by investing some of your cash holdings or maximizing yields (cash is finally paying decent yields!) if these funds are earmarked for upcoming expenses.

Rebalancing:

When possible, prioritize tax-deferred and tax-free accounts for the majority of your portfolio rebalancing to your target asset allocation percentages, minimizing potential tax consequences.

Tax Loss Harvesting: Additionally, explore tax-loss harvesting as a strategy to offset gains and lower your ordinary income during the rebalancing process.

Conclusion:

It's crucial to recognize that Americans, on average, pay a staggering $525,037 in taxes throughout their lifetime, as revealed by Self Financial's analysis of Bureau of Labor Statistics data. Consequently, the strategic avoidance or deferral of taxes becomes a powerful tool, substantially enhancing your journey toward financial independence.

For personalized guidance on tax saving techniques or tax-efficient asset allocation strategies, reach out to Prepared Financial Planning LLC for a free assessment here or send us an email: andrew@preparedfp.com.

To subscribe to future articles, sign up below:

For disclosure information click here.

Unlock your Health Savings Accounts (HSAs) Full Tax Savings and Investment Potential

As open enrollment season for healthcare plans approaches, combined with the reality that retirement healthcare expenses often exceed a staggering $300,000 for couples, there’s no better time to explore Health Savings Accounts (HSAs). These accounts are designed to help individuals and families prepare for future medical costs but can also serve as a powerful triple tax-advantaged investment vehicle. Surprisingly, many new clients haven’t been fully harnessing HSA’s entire tax and investment benefits.

If you're healthy and don’t anticipate significant medical expenses next year, now is the time to consider maximizing your HSA contributions. In this blog post, we'll explore why HSAs should be considered as part of your financial plan and how they have the potential to save you thousands of dollars in taxes.

Why Consider an HSA?

Immediate Tax Deduction: HSA contributions are tax-deductible in the year you make the contribution. For example, if you’re in the 24% federal tax bracket and have a family HSA, you can save $1,992 on your 2024 federal tax return ($8,300 x 24%). Many states also provide an additional state tax deduction, and contributing with pre-tax dollars allows you to avoid the 7.65% FICA payroll tax (e.g., Social Security and Medicare).

Tax-Free Investment Growth: Consider investing your HSA funds to benefit from tax-free dividends, capital gains, and interest. For instance, if you’re in the 24% federal tax bracket, dividends and capital gains will typically be taxed federally at 15% or 18.8%, whereas interest would be taxed at your federal ordinary income tax rate of 24%.

Tax-Free Withdrawals: When HSA funds are used for qualified medical expenses, withdrawals are tax-free. For example, if you’re in the 24% federal tax bracket, it’s important to note that long-term capital gains on sales would typically be taxed federally at 15% or 18.8%.

Flexibility: HSAs can be rolled over after you switch jobs and retained during retirement.

Strategic Use of Funds:

Maximize Investment Growth:

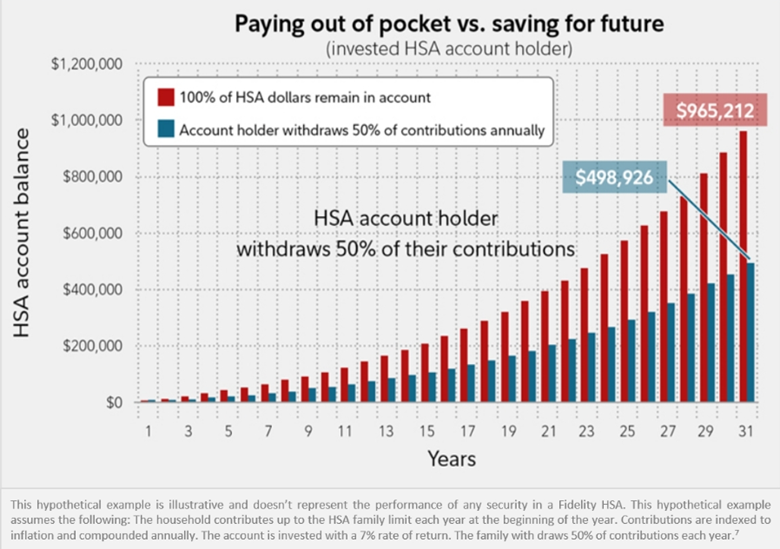

After funding your HSA, consider using non-HSA funds for immediate medical expenses. This strategy allows your HSA balance to remain invested for potential growth. To illustrate, let’s use an example: Assuming a 7% investment return, if you keep your HSA invested for 30+ years, you could potentially have approximately $450,000 more than someone who withdraws 50% of their HSA balance annually for current medical expenses.

We generally recommend a more aggressive investment approach for HSAs in your portfolio (e.g., more stocks), as these are tax-free assets. However, the suitability of this approach depends on factors like your time horizon, risk tolerance, and capacity for risk.

Source: Fidelity.com

Record-Keeping Importance: When using non-HSA funds for current medical expenses, keep detailed records since you can take tax-free HSA distributions at any time for prior qualified medical expenses incurred after establishing the HSA. This approach is particularly advantageous during retirement, and we often recommend distributing funds for prior medical expenses around the ages of 70 to 80, allowing for many years of tax-free investment growth.

Future Health Care Costs

For reference, a 65-year-old couple retiring this year can expect to spend an average of $315,000 in health care and medical expenses during their retirement, according to an estimate by Fidelity Investments, so HSAs assist with future medical expenses.

Contribution limits:

2023: individual $3,850; family $7,750 (age 55 and older have additional catch-up contribution of $1,000)

2024: individual $4,150; family $8,300 (age 55 and older have additional catch-up contribution of $1,000)

Reminders: To contribute to an HSA, you need to be enrolled in an HSA-eligible health plan and can’t be enrolled in Medicare. This means:

Minimum Deductible Amount for 2023: Single $1,500; Family $3,000

Maximum Out-of-Pocket Amount for 2023: Single $7,500; Family $15,000

Other Considerations:

Be aware that there is a penalty for withdrawing funds for non-qualified medical expenses before age 65, which is generally 20%. You would also be subject to income taxes on the non-qualified withdrawal.

Be mindful that if the beneficiary is not a spouse, the HSA will no longer be treated as a tax-free HSA upon inheritance, and the fair market value of the HSA becomes taxable income to the beneficiary.

Conclusion:

Health Savings Accounts (HSAs) represent a powerful investment vehicle with triple tax advantages that can significantly improve your goal of reaching financial independence. With estimated healthcare costs in retirement often surpassing $300,000, contributing to an HSA is often a prudent financial decision.

For personalized guidance on HSAs or to ensure you are taking advantage of other tax strategies, reach out to Prepared Financial Planning LLC for a free assessment: https://www.preparedfp.com/assessment or send us an email at andrew@preparedfp.com.

For disclosure information click here.